transfer taxes refinance georgia

The exemption is an amount that you can transfer without incurring a gift estate or generation skipping transfer GST tax cost. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000.

Code 48-6-1 Tax rate for real estate conveyance instruments Georgia Code 2013 Edition There is imposed a tax at the rate of 100 for the first 100000 or fractional part of 100000 and at the rate of 10 cents for each additional 10000 or fractional part of 10000 on each deed instrument or other writing by which any lands tenements or other realty sold is.

. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. Atlanta Title Company LLC 945 East Paces Ferry Road Suite 2250 Resurgens Plaza Atlanta GA. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza Atlanta GA 30326.

Intangible Tax 300 per thousand of the sales price. Title Insurance 200 per thousand of loan amount. Requirement that consideration be shown OCGA.

Atlantas median home value is 208100 which means the transfer tax would be around 208. Requirement that consideration be shown 48-6-3 - Persons required to pay real estate transfer tax. Real Estate- Transfer taxes are negotiable in the contract but in most states the seller pays the tax if its not addressed in the contract.

2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2 - Exemption of certain instruments deeds or writings from real estate transfer tax. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST. Rbc Royal Bank Fixed And Variable Mortgage Rates Mar 2022 From 1 95 Wowa Ca.

Once the tax has been paid the clerk of the superior court or their deputy will attach to the deed instrument or other writing a certification that the tax has been paid. The transfer tax rate in Georgia is 1 per 1000 of assessed value. In Georgia anyone taking out a mortgage loan must pay a one-time intangible Georgie mortgage tax on the loan amount within 90 days of the instruments recording.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. 13th Sep 2010 0328 am. Georgia Transfer Tax 100 per thousand of sales price.

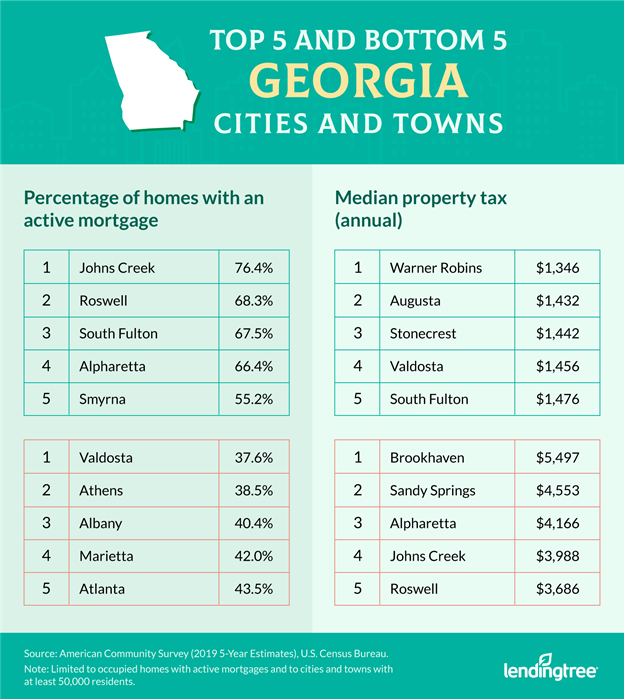

Staf Ex101 6 Htm. To make this rate a bit more practical lets take a couple of examples based on the median home value in several cities. Georgia Title Transfer Tax Intangibles Tax Mortgage Tax.

2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-2 - Exemption of certain instruments deeds or writings from real estate transfer tax. Regarding transfer taxes most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement. This just goes to show how dramatically different Florida transfer taxes can be based solely on where the transfer of property is taking place.

State Transfer Tax is 05 of transaction amount for all counties. How Much Are Transfer Taxes in Georgia. Mortgage Archives David Watts Notary Public.

Refinance Mortgage Transfer Tax in Georgia. Who pays transfer tax at closing. In a refinance transaction where property is not transferred between two parties no deedtransfer taxes are due.

Georgia Transfer Tax Calculator. The median sale price in Miami is 370738. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded.

The current tax rate is 110 per 1000 or 055 per 500. For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes. Is there a transfer tax on a refinance.

Original mortgage was for 500000 and the principle payoff is now 350000. Intangibles Mortgage Tax Calculator for State of Georgia. Who Pays What In The Los Angeles County Transfer Tax.

Georgia Transfer Tax Calculator. On any amount above 400000 you would have to pay the full 2. Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell.

Atlanta Title Company LLC 945 East Paces Ferry Road Suite 2250 Resurgens Plaza Atlanta GA 30326. Currently the intangible tax is imposed at the rate of 150 per 500 or 3 per 1000 based upon the loan amount. 370738100 x 60 222443.

That means a person financing a property for 550000 pays. However in most jurisdictions you must pay the State Revenue Stamps this amount varies by county on the new money being borrowed. In some states the transfer tax is known by other names including deed tax mortgage registry tax or stamp tax.

The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100. I am refinancing my current mortgage and one of my potential lenders is stating that I need to a pay a mortgage transfer tax at closing. The California Revenue and Taxation Code states that all the counties in California have to pay the same rate.

07th Sep 2010 0515 pm. The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note. The borrower and lender must remain unchanged from the original loan.

In other words you will only be responsible for paying revenue. So if your home sells for 600000 the property transfer tax is 660. If the holder of an instrument conveying property located both within and without the State of Georgia is a nonresident of Georgia the amount of tax due would be 150 per 50000 or fraction thereof of the principal of the note times x the ratio of the value of real property located in Georgia to the value of all real property in-state and out-of-state securing the note.

Transfer taxes would come out to. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of the principal payoff and the new mortgage. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2 - Exemption of certain instruments deeds or writings from.

Local state and federal government websites often end in gov. In Miami-Dade County your rate is 60 cents per 100. Before sharing sensitive or personal information make sure youre on an official state website.

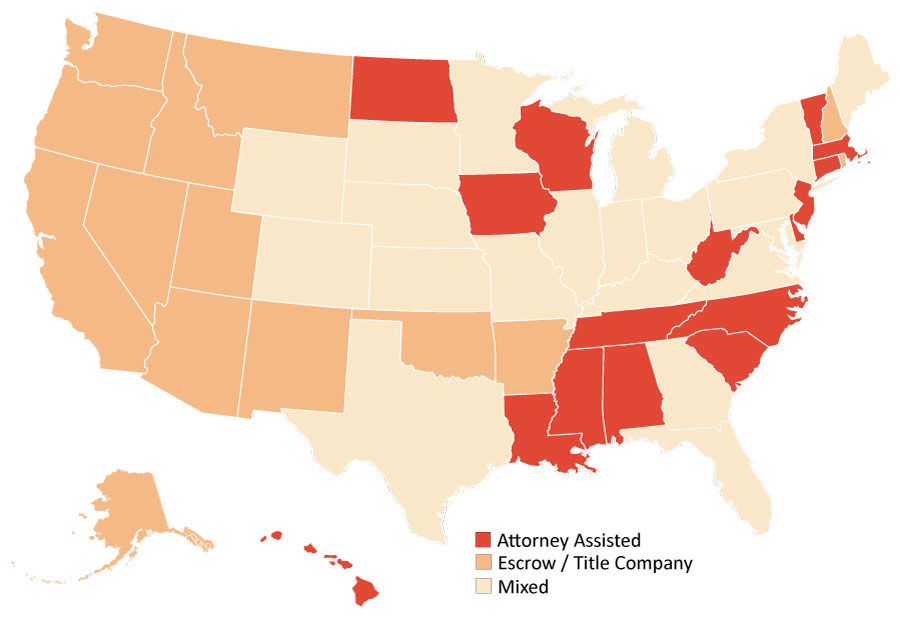

A transfer tax is the city county or states tax on any change in ownership of real estate. Recording Transfer Taxes Sales Use Taxes Fees. The closing of a real estate transaction in Georgia must be performed by a licensed Georgia attorney.

A transfer tax may be levied from a government entity within the United States including any city county or state but most real estate.

7 Useful Things You Need To Know About Georgia Quit Claim Deed Forms The Hive Law

Transfer Tax Calculator 2022 For All 50 States

Georgia Inheritance Laws What You Should Know Smartasset

6 Mistakes To Avoid When Refinancing Your Home Georgia S Own

Should I Transfer The Title On My Rental Property To An Llc

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

Virginia Real Estate Transfer Taxes An In Depth Guide

Georgia Buyer Closing Costs How Much Will You Pay

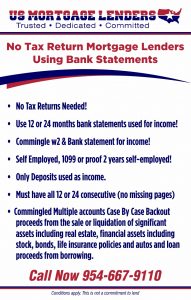

Bank Statement Georgia Mortgage Lenders No Tax Returns Needed

Georgia Real Estate Transfer Taxes An In Depth Guide

5 Ways The Rich Can Avoid The Estate Tax Smartasset

State By State Closing Guide Sandy Gadow